Are you a contractor looking for an efficient way to manage your finances? You’re not alone. Many professionals in the construction industry struggle to find the right accounting software that caters to their specific needs. In this blog post, we will delve into QuickBooks Contractor, a solution specifically designed to resolve the financial management problems faced by contractors. We acknowledge the challenges you face in keeping track of your financial transactions and promise to provide a comprehensive solution through this review.

We will give you an overview of the features and pricing of QuickBooks Contractor for 2023, proving that this software could be the answer to your accounting woes. By addressing your pain points, such as job costing, tracking expenses, and managing cash flow, we aim to grab your attention and help you make an informed decision. We’re confident that by the end of this post, you’ll have a clear understanding of how QuickBooks Contractor can revolutionize your business’s financial management.

What is QuickBooks Contractor?

A brief introduction to QuickBooks Contractor

QuickBooks Contractor is a tailored accounting software solution designed specifically for contractors and professionals in the construction industry. With its unique features, this software simplifies the complex financial management tasks contractors often face. QuickBooks Contractor provides a streamlined and user-friendly platform that allows you to manage your finances effectively and efficiently.

Importance in the construction industry

In the construction industry, managing finances can be a daunting task due to the unique nature of the business. Projects may require intricate job costing, labor management, and materials tracking. QuickBooks Contractor understands these challenges and offers specialized tools to help you stay on top of your financial obligations. Providing a software solution tailored for contractors simplifies financial management and ensures your business runs smoothly.

Key Features of QuickBooks Contractor

Job costing and reporting

One of the most vital aspects of managing construction finances is job costing. QuickBooks Contractor offers advanced job costing features that allow you to track project costs accurately. By allocating expenses to specific jobs, you can monitor profitability and make informed decisions. Additionally, the software provides comprehensive reporting, enabling you to analyze project performance and identify areas for improvement.

Expense tracking and categorization

Managing expenses is crucial for any business, but it’s especially important in the construction industry. QuickBooks Contractor simplifies expense tracking by allowing you to categorize expenses by job or project. This makes it easy to review your financial data and ensure your budget stays on track. With real-time expense tracking, you’ll have the information you need to make informed financial decisions.

Customizable invoicing and billing

Invoicing and billing are essential aspects of construction financial management. QuickBooks Contractor offers customizable invoicing and billing options to suit your business needs. You can create professional-looking invoices that include your company logo, and even set up automated invoicing for recurring charges. This saves you time and ensures your clients receive timely and accurate bills.

Cash flow management

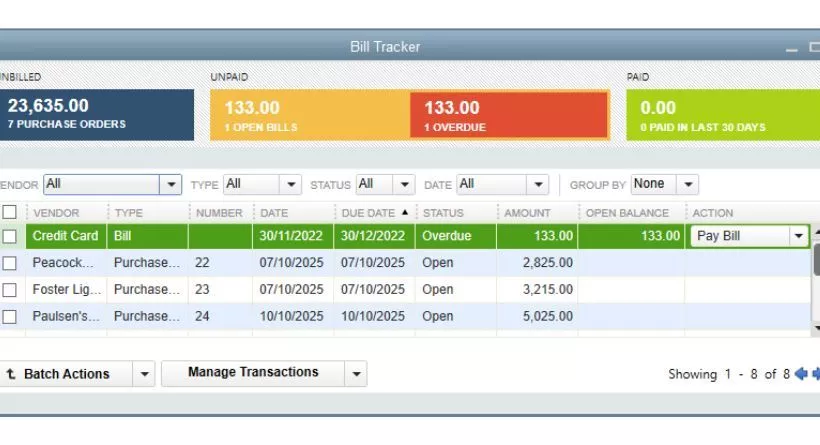

Effective cash flow management is vital for the success of any construction business. QuickBooks Contractor provides cash flow forecasting tools, helping you anticipate your financial needs and make adjustments as necessary. By monitoring your cash flow, you can avoid potential financial pitfalls and ensure your business remains financially stable.

Time tracking and payroll integration

Labor costs are a significant part of any construction project. QuickBooks Contractor features time tracking and payroll integration, making it simple to manage your workforce expenses. With the ability to track employee hours and integrate payroll data, you can accurately calculate labor costs and ensure your team is paid on time.

Integration with other software and apps

QuickBooks Contractor is designed to work seamlessly with other software and apps, increasing its functionality and versatility. By integrating with popular project management and estimating tools, you can streamline your workflow and improve efficiency. This integration allows you to access all your essential financial data in one place, simplifying your financial management process.

Also read: 5 Marketing Agencies That Are Killing the Social Media Game

QuickBooks Contractor Pricing for 2023

Subscription plans and pricing

QuickBooks Contractor offers various subscription plans to accommodate the diverse needs of construction professionals. These plans provide different levels of features and functionality, ensuring you can find the perfect fit for your business. Pricing for 2023 is expected to be competitive, making QuickBooks Contractor an affordable option for contractors of all sizes.

Comparison with other QuickBooks products

When compared to other QuickBooks products, QuickBooks Contractor stands out due to its specialized features tailored to the construction industry. While other QuickBooks products may provide general accounting tools, QuickBooks Contractor goes a step further by offering features like advanced job costing, customizable invoicing, and integration with construction-specific software.

Value for money

Considering the unique features and tools provided, QuickBooks Contractor offers excellent value for money. Its specialized tools for construction professionals, such as job costing, invoicing, and payroll integration, can save time and reduce errors. By investing in QuickBooks Contractor, you can improve your business’s financial management and enhance overall efficiency.

Pros and Cons of QuickBooks Contractor

Advantages of using QuickBooks Contractor

QuickBooks Contractor has numerous advantages tailored to the construction industry. Its advanced job costing and reporting features help you monitor project profitability accurately. Expense tracking and categorization make managing your finances a breeze, while customizable invoicing and billing options save time and ensure professional communication with clients. Additionally, seamless integration with other construction software and apps streamlines your workflow, making QuickBooks Contractor an invaluable asset for your business.

Limitations and drawbacks

Despite its many benefits, QuickBooks Contractor has a few drawbacks. Some users may find the initial learning curve steep, especially if they are new to accounting software. The software may also lack advanced features desired by larger construction companies or those with more complex financial management needs. Finally, QuickBooks Contractor may not be the best fit for businesses outside the construction industry, as its specialized features cater specifically to contractors.

Also read: Tucker Carlson’s Net Worth: Fox News Host’s Fortune and Salary Explored

How to Get Started with QuickBooks Contractor

Setting up your account

Getting started with QuickBooks Contractor is simple. First, choose a subscription plan that fits your business needs. Next, create your account and follow the guided setup process to input your company information and preferences. Once your account is set up, you can start exploring the software’s features and customizing them to suit your needs.

Tips for customizing the software to suit your needs

To make the most of QuickBooks Contractor, take the time to customize it to your business requirements. Start by setting up your chart of accounts and job costing preferences. Configure your invoicing and billing templates to reflect your company branding. Additionally, explore integrations with other software and apps you use, such as project management and estimating tools, to streamline your workflow.

Accessing customer support and resources

QuickBooks offers a range of customer support and resources to help you make the most of the software. Access online forums, video tutorials, and articles for guidance on specific features and tasks. If you require further assistance, contact the QuickBooks support team through chat, email, or phone.

QuickBooks Contractor Alternatives

Comparison with other accounting software for contractors

While QuickBooks Contractor is a popular choice, it’s essential to explore other accounting software options to ensure you select the best fit for your business. Some alternatives include Zero, Sage, and FreshBooks, which offer similar features and may cater to different business sizes or industries. Compare the features, pricing, and integrations of these alternatives to determine which best suits your needs.

Factors to consider when choosing accounting software

When evaluating accounting software options, consider factors such as ease of use, scalability, and integration with existing software and apps. Also, assess the quality of customer support and the availability of resources for learning and troubleshooting. Finally, consider the overall value for money and whether the software meets your specific financial management needs. By carefully evaluating your options, you can choose the right accounting software to streamline your construction business’s financial management.

Also read: Top 10 Richest Cities in the World with Most Billionaire

Conclusion

In summary, QuickBooks Contractor is a specialized accounting software solution designed to address the unique financial management needs of the construction industry. With features like job costing, expense tracking, customizable invoicing, cash flow management, and seamless integration with other software, it simplifies and streamlines financial processes for contractors. Despite a few drawbacks, its competitive pricing and tailored tools make it a valuable investment for your business. By carefully evaluating your options and considering your specific needs, you can choose the right accounting software to improve your business’s financial management and overall efficiency. Good luck in your search and may your construction business thrive!