Accurate and timely payment of salaries is crucial to maintaining employee morale and business productivity. A single mistake or delay can have a significant impact on employees who rely on their monthly income. However, it’s not just about paying employees on time; complying with labor laws, PF, PT, and other statutory requirements is equally important. Failure to do so can lead to serious legal and financial consequences. As a business owner, it’s essential to prioritize payroll accuracy and compliance to ensure the smooth running of your business and the well-being of your employees.

Maintaining a happy and compliant workforce requires a proper understanding of payroll management. To ensure your employees receive accurate and timely payments, it’s crucial to have a solid grasp of the basics of payroll management. This includes familiarizing yourself with the payroll process, calculating wages and taxes, and complying with relevant labor laws and regulations. By mastering these fundamentals, you can help keep your employees motivated and productive while avoiding legal and financial consequences.

What is Payroll?

Payroll is a crucial function of any business and involves several steps to ensure timely and accurate payment of employees. These steps include:

- Developing the organization’s pay policy, which includes flexible benefits, leave encashment policy, and other related policies.

- Defining payslip components such as basic pay, variable pay, house rent allowance (HRA), and leave travel allowance (LTA).

- Gathering payroll inputs from various sources, such as information about meals consumed by employees from the organization’s food vendor.

- Calculating the gross salary and deducting statutory and non-statutory deductions to arrive at the net pay.

- Releasing employee salaries on time to ensure their financial stability.

- Depositing dues such as TDS (Tax Deducted at Source), PF (Provident Fund), and other statutory contributions with appropriate authorities and filing returns.

Simply put, the payroll process calculates the ‘net pay’ or amount due to employees after accounting for taxes and deductions. This involves a detailed and accurate calculation of gross salary, which includes various payslip components such as basic pay, variable pay, HRA, and LTA, as well as statutory and non-statutory deductions. The payroll process also involves defining and implementing an organization’s pay policy, gathering payroll inputs from various sources, releasing employee salaries, and ensuring compliance with legal and regulatory requirements.

What are the Stages to Processing Payroll?

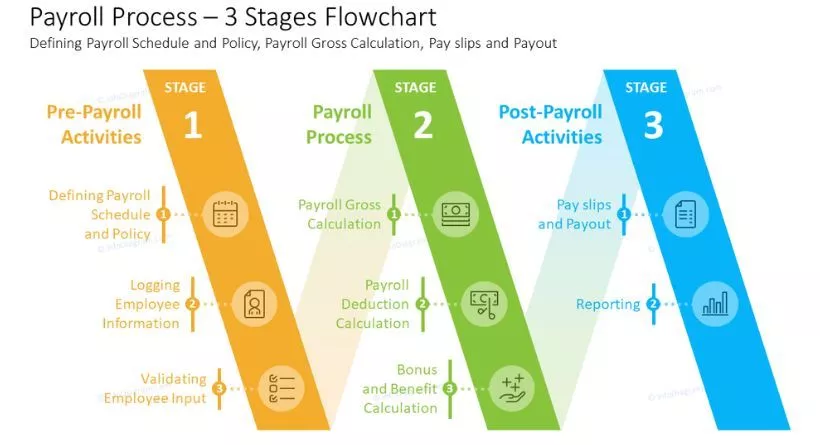

Effective payroll management requires proper planning and attention to ongoing tasks, such as monitoring changes to withholdings and contributions to social security funds. The payroll process can be broken down into three stages: pre-payroll activities, actual payroll processing, and post-payroll activities.

Pre-Payroll Activities

Defining Payroll Policy

Calculating the net amount to be paid to employees requires taking multiple factors into account. This includes the company’s policies on pay, benefits, attendance, and leave, among others. To ensure a smooth and standard payroll process, it is important to carefully define and obtain approval for these policies from management before beginning payroll calculations.

Gathering Inputs

Effective payroll processing requires collaboration between various departments and personnel. Data such as mid-year salary revision and attendance data are critical components of the process. In smaller organizations, this information is usually consolidated from a few teams. However, in larger organizations, data collection can be a daunting task. By leveraging smart payroll systems with integrated features like leave and attendance management, and employee self-service portals, data collection becomes a more manageable process.

Input Validation

Ensuring accuracy in payroll processing is crucial, and it begins with validating the received inputs. The data should be reviewed for compliance with company policies, correct authorization and approval matrix, appropriate formats, and other factors. The process must also ensure that active employees are not missed out and that inactive employee records are not included in the payroll. To ensure accurate payroll, you can refer to the top 6 payroll validation methods.

Actual Payroll Process

Payroll Calculation

Once the input data is validated, it is time to feed it into the payroll system for actual processing. The end result is the net pay after necessary deductions and taxes are adjusted. After the payroll process is complete, it’s crucial to reconcile the values and verify their accuracy to avoid potential errors.

Post-Payroll Process

Statutory Compliance

During payroll processing, statutory deductions such as EPF, TDS, and ESI are deducted, and the corresponding amounts are remitted to the relevant government agencies by the company. The frequency of payments can vary depending on the type of dues. To pay these dues, companies often use challans. After the dues are paid, reports or returns are filed. For example, the PF return is filed by generating and submitting an ECR.

Payroll Accounting

Keeping track of financial transactions is crucial for every organization. Payroll expenses, including salaries and reimbursements, must be accurately recorded in the books of accounts. To ensure this, it is essential to integrate the payroll system with the accounting or ERP system. This helps in maintaining an accurate and up-to-date record of all financial transactions related to payroll management.

Payout

When it comes to paying employee salaries, organizations have several options such as cash, cheque, or bank transfer. Most organizations nowadays provide their employees with a salary bank account. Once the payroll process is complete, it is important to ensure that the company’s bank account has enough funds to make the salary payment. A salary bank advice statement should then be sent to the relevant branch containing details such as employee ID, bank account number, and amount of wages. To simplify the process, a payroll management software with an employee self-service portal can be utilized to publish payslips and enable employees to access them with ease.

Reporting

After completing the monthly payroll run, the finance and management team may require reports on employee costs categorized by department or location. As a payroll officer, you must analyze the data and gather the necessary information to create and distribute the reports to the appropriate parties.

Statutory Compliance in Indian Payroll

When running payroll, it’s essential to comply with statutory regulations, which are employment norms established by the central and state legislation. In India, common statutory requirements include minimum wage provisions, payment of overtime wages to workers, TDS deduction, and contributions to social security schemes such as PF and ESI.

All these deductions and contributions should be considered while computing salaries. Income tax is another important deduction, and at the beginning of the year, employees are asked to submit their income tax declarations, which include details about additional income and tax-saving investments. Based on these declarations, the employee’s tax liability is calculated, and TDS is deducted accordingly.

Calculating monthly tax liability and deducting TDS based on the applicable tax slabs is crucial for any organization. Once the TDS is deducted, it needs to be deposited with the government monthly, and a quarterly report of all deductions needs to be filed. Form 16 must be issued to employees after completing the TDS returns for the fourth quarter, which serves as proof of tax deducted while filing their individual income tax return.

Adhering to statutory tax laws is essential to avoid hefty fines and penalties. It’s important to stay updated with all tax and payroll statutory changes to ensure compliance and avoid legal implications.

Challenges in Handling Payroll Management Process

The payroll process becomes challenging due to two main reasons.

The Requirement to stay Statutory Compliant

Non-compliance with statutory laws can result in heavy fines and penalties and can even pose a threat to the survival of a business. Fortunately, with the advent of advanced payroll management software, companies can ensure compliance with statutory laws automatically during the payroll processing. These software solutions streamline payroll compliance and help companies stay on top of changing statutory regulations.

Dependence on Multiple Payroll Inputs Sources

Processing payroll requires collecting data from various sources like attendance registers, conveyance facility records, salary revision information from HR team, etc., making it a complex task. For years, HR and payroll officers have relied on Excel sheets to manage payroll, but this approach has limitations such as dependence on complex formulas for salary calculations, difficulty in adding and removing employees, manual data entry, and challenges in extracting information.

Fortunately, with the advent of advanced payroll management software, these challenges can be overcome. Automated software can streamline the payroll process, eliminating manual errors and saving time and effort. By leveraging modern payroll solutions, businesses can ensure compliance with statutory regulations and improve payroll efficiency.

Various Methods Available to do Payroll for your Business

The possible options for running payroll can be

- Excel based payroll management

- Payroll outsourcing

- Using payroll software

Excel based Payroll Management

Excel-based payroll management is a common method chosen by small businesses with a limited number of employees. This method involves the use of an excel sheet with pre-defined formulas for calculating payroll. Though it is cost-effective, there are several limitations to this approach. The limitations include the complexity of adding or removing employees, manual data entry, difficulty in extracting information, and a high dependency on excel formulas for salary calculation.

- When it comes to managing payroll on excel sheets, there are inherent limitations that can hinder accurate and efficient payroll processing.

- One of the major drawbacks of excel based payroll management is the high chances of clerical and mathematical errors, as data is entered manually.

- Another limitation is the difficulty in adding and removing employees from the payroll list, which can be a time-consuming process.

- Chances of duplicate data and omission of entries at times can also occur, leading to inaccurate payroll calculations and potential legal issues.

- In addition, monitoring tax updates and other statutory changes like PF, PT etc. can be a challenging task, making it essential to stay up-to-date with the latest regulations.

Payroll Outsourcing

Outsourcing payroll can be a beneficial option for businesses without a dedicated payroll team. The process involves providing salary and employee data to an external agency, who then calculates the payroll and ensures statutory compliance. However, businesses may be hesitant to outsource due to concerns about transparency and control over this critical function.

Payroll Software

As a payroll officer, it’s essential to ensure that all payroll inputs are gathered on time to process a successful payroll. Today, there are advanced payroll management software that significantly streamline the process. These software tools not only automate payroll computation but also serve as an all-in-one solution for leave and attendance management, HR management, and employee self-service portal. The size of your business and specific needs will determine the most suitable payroll software for your organization.

Best Payroll Software for your Organization

Switching from manual to automated payroll can boost efficiency and productivity by saving time, ensuring accuracy, and keeping all stakeholders satisfied. In choosing a payroll management software, it’s essential to consider certain key features. These features may include robust data security measures, integration with attendance and leave management modules, compliance with relevant statutory regulations, and easy-to-use employee self-service portals.

Ease of Operation

Managing payroll can be a daunting task, which is why it’s essential to choose a software with simple but comprehensive workflows. An intuitive system can save time and reduce the need for software training. Additionally, ensure that the software provider offers up-to-date documentation that can be accessed at any time to provide the necessary guidance.

Scalability

Your payroll software should be scalable and able to handle your growing organizational needs. As your business expands, the software should accommodate the increasing volume of employee data and offer advanced features like leave and attendance management, reimbursement models, etc. It’s important to choose a software provider that offers scalable solutions at a reasonable price to ensure that your software grows with your organization.

Employee Self-Service Module

Employees play a crucial role in providing payroll inputs, including details of their income tax-saving investments and flexible benefit options. Typically, communication between payroll officers and employees occurs on an event-based basis. To illustrate the importance of an Employee Self-Service (ESS) module, let’s consider a scenario where an employee declares their income tax savings in two different situations:

Implementing an employee self-service portal can significantly streamline the payroll process and minimize manual intervention. This tool can automate the collection of payroll data and ensure accurate tax computation. With an employee self-service portal, employees can conveniently update their tax declarations and other important information, eliminating the need for manual data entry and reducing the chances of errors.

Integration with Time, Attendance and Leave Management System

Time Management

Tracking time spent on specific projects or activities can be crucial for certain industries like consulting firms, specialist doctors, etc. A robust time management module can help them keep track of time and even use this data for billing clients. This feature is commonly found in project management software.

Attendance

Managing employee attendance is crucial for seamless payroll processing. While small organizations often opt for manual attendance systems, larger businesses have turned to automated tools like biometric methods, system log-in tracking, access cards, and iris capture. These methods store data in a system that can be linked to payroll software for accurate calculation of attendance days and overtime. To ensure effective attendance management and payroll processing, it’s important to choose software that supports attendance management and is configurable with access control machines.

Leave Management

Leave management is a crucial aspect of every organization, as employees are entitled to various types of leaves such as casual, sick, holiday, and more. By incorporating leave management feature in the payroll software, HR can credit eligible employees with the correct amount of leave. Employees can apply for leave directly through the system, and a defined workflow should be in place to notify the manager for approval or rejection. A well-designed payroll software with robust leave management capabilities ensures accurate payroll processing.

Integration with the Accounting System

Payroll information, including employee cost and individual payroll components such as reimbursements and taxes, must be recorded in your accounting/ERP system as a financial transaction. Integrating your payroll software with your accounting software via API can help achieve this integration automatically. However, without integration, the payroll officer must provide all transaction details to the accounts department, who will manually post them in the form of journal entries in accounting/ERP software like Tally ERP, SAP, Quickbooks, etc. By integrating payroll and accounting software, finance and payroll teams can work together efficiently and avoid the need for manual data entry.

Cloud-Based Software over On-Premise Solutions

The realm of payroll management automation is witnessing a rapid transformation. The traditional on-premise software solutions are becoming outdated, and companies are increasingly opting for cloud-based solutions, owing to their numerous benefits.

Ability to Access the Data at Any Time and From Anywhere

A cloud-based payroll software is an excellent choice for businesses that require flexibility and remote accessibility. With a cloud-based system, you can easily access your payroll data and employee information from anywhere, at any time, similar to accessing your email. No longer do you need to be present in your office to manage your payroll tasks, making it an ideal solution for companies with remote teams or multiple locations.

The Advantage over the Inherent Limitations of On-Premise Systems

The traditional on-premise systems pose a risk of data loss due to disasters like fire, floods, etc. Additionally, these systems require high initial setup costs and come with operational limits. The annual maintenance costs can also be significant. On the other hand, cloud-based payroll management solutions offer numerous advantages. You can easily upgrade to higher plans that support increased operations without any hassle. Moreover, cloud solutions are built on robust technology and have data centers located in multiple locations, ensuring the safety of your data even during natural calamities.