You’ve seen it in the news, you’ve heard it in conversations, the “Corona Third Wave” is looming, and it’s causing more than just health-related worries. Many of you are grappling with the nagging uncertainty – will this wave crash upon the shores of your financial stability, particularly in terms of life insurance premium rates? Yes, we acknowledge the gravity of your concern.

Being specialists in finance and insurance sectors, we understand how the ripple effect of a pandemic wave can inundate insurance premiums, leaving you perplexed and stressed. But worry not. This blog post intends to be your lighthouse amidst the stormy sea of information. We commit to offering you a comprehensive and transparent breakdown of the factors that may lead to alterations in life insurance premiums in the wake of the Corona Third Wave.

By navigating the intricate interplay between pandemic scenarios and insurance costs, we will help you understand why and how your life insurance premium rates could be impacted. Furthermore, this post will guide you through strategic ways to manage your insurance policy, providing you with solutions to mitigate any potential financial burden.

Now, imagine being caught in a sudden downpour without an umbrella. That’s how it feels facing the Corona Third Wave without the right knowledge about its impact on your life insurance premiums. We are here to offer you that umbrella, sheltering you with vital insights and a strategic roadmap. Let’s delve into the matter together.

Understanding the Relationship between Pandemics and Insurance Rates

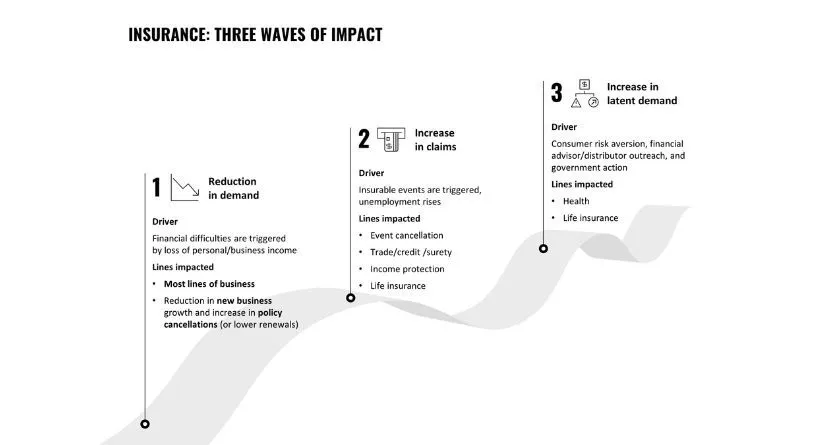

Global pandemics, such as the Corona Third Wave, undeniably ripple through the insurance sectors. It’s akin to a stone thrown into a calm pond; the impact radiates outward, influencing everything in its path. In simpler terms, insurance companies assess risk to set premiums. Pandemics add a new layer of risk, and consequently, insurance companies may adjust premiums to account for that increased risk.

Let’s reflect on the past, to understand this better. During the first and second Corona waves, we saw a marked influence on life insurance premiums. In fact, according to a report by the Insurance Regulatory and Development Authority, there was a noticeable increase in life insurance premiums, particularly for high-risk age groups.

The Corona Third Wave and its Potential Impact on Life Insurance Premiums

Analyzing the factors that may lead to changes in premium rates is akin to weather forecasting. Just as meteorologists look at pressure systems, temperature and wind direction to predict weather, we’re examining the landscape of the Corona Third Wave.

Predictions from industry experts suggest a potential rise in life insurance premiums. For instance, Richard Liu, a leading analyst at the Global Insurance Institute, projects an uptick in life insurance premiums during the Corona Third Wave. These increases are likely driven by factors such as a larger insured population and higher claim payouts during the pandemic.

Dealing with the Potential Increase in Premiums

Now that we’ve forecasted the potential storm, how do we prepare for it? In the world of insurance, there are some proactive steps you can take.

One way to prepare for potential premium increases is to consider a premium freeze, if your policy allows. This means your premiums remain constant for a certain period, regardless of external influences. Further, strategies such as topping up your emergency fund, reassessing your policy, and diversifying your insurance portfolio can help maintain financial stability amid the Corona Third Wave.

Case Study: How Insurers Adapted During the First and Second Corona Waves

Let’s take a leaf from the book of past experiences. During the first and second Corona waves, insurers and policyholders alike employed effective strategies to navigate the upheaval.

Insurers made swift adjustments, such as extending grace periods for premium payments, providing premium discounts, and expediting claim settlements. Policyholders, on the other hand, explored options such as premium payment holidays, and insurance loan facilities.

Navigating through the Corona Third Wave, we can leverage these strategies, adapt and ensure our financial resilience.

Remember, knowledge is your compass in the tumultuous seas of uncertainty. Let’s sail through this Corona Third Wave, equipped and ready!

Conclusions: Looking Ahead

As we navigate the vast sea of the Corona Third Wave, we understand the profound impact it could have on our life insurance premiums. Just like a compass pointing north, our investigation into past pandemics and their influence on insurance rates helps us anticipate the likely scenario. With potential increases in premiums, it’s paramount to employ strategies that safeguard our financial well-being.

However, it’s not a solo journey. We can learn from the experiences of insurers and policyholders during the first and second waves. Armed with that wisdom, you can chart your course, prepare for stormy weather, and weather any financial storm the Corona Third Wave might bring.

Remember, forewarned is forearmed. With awareness, planning, and action, we can not only survive this Corona Third Wave but also ensure our financial stability remains unscathed. Stand tall, look ahead, and sail confidently into the future.